When you walk into a clinic or urgent care center, you probably don’t think about how much the antibiotics or lidocaine injections cost the provider. But for healthcare practices, those costs add up fast. In 2023, generic drugs made up over 90% of all prescriptions filled in the U.S., yet they accounted for just under 25% of total drug spending. That gap? It’s not magic. It’s bulk purchasing.

How Bulk Buying Lowers Generic Drug Prices

Generic drugs aren’t cheaper because they’re weaker. They’re cheaper because they don’t need expensive clinical trials - the brand-name drug already proved it works. The FDA approves them through a faster process called the ANDA. That’s why a 30-day supply of metformin can cost $4 at Walmart and $400 at a hospital pharmacy without bulk deals. The real savings come from volume. When a clinic buys 10,000 units of amoxicillin instead of 1,000, manufacturers and distributors offer steep discounts. Direct discounts for orders over 1,000 units typically range from 5% to 15%. For orders over 10,000 units, discounts can hit 20% to 30%. That’s not theory - it’s what Texas urgent care centers saw after switching to quarterly bulk orders. But here’s the catch: not all bulk deals are created equal. The biggest savings don’t always come from the big wholesalers like McKesson or Cardinal Health. They control 85% of the market, but their discounts are often just 3% to 8%. The real bargains come from secondary distributors like Republic Pharmaceuticals. These smaller players specialize in bulk deals for high-use generics and offer 20% to 25% off - sometimes more.Short-Dated Stock: The Hidden Discount Channel

One of the smartest ways to cut costs is by buying short-dated stock. These are generic medications with expiration dates within 6 to 12 months. They’re perfectly safe. They’re just sitting in warehouses because pharmacies don’t want to risk running out before they expire. Clinics that use this strategy report 20% to 30% savings on injectables like lidocaine, corticosteroids, and saline. One Ohio clinic cut its injectable costs by 25% in just one quarter by switching 40% of its orders to short-dated stock. No change in patient care. No new training. Just smarter buying. The downside? You need good inventory tracking. If you order too much and it expires, you lose money. Successful practices spend 5 to 10 hours a month monitoring expiration dates and adjusting orders based on actual usage. Some use automated systems that sync with their electronic health records to trigger reorders when stock hits a certain level. That’s how the Texas clinic kept zero stockouts while saving 20%.Who’s Really Saving Money? PBMs and State Pools

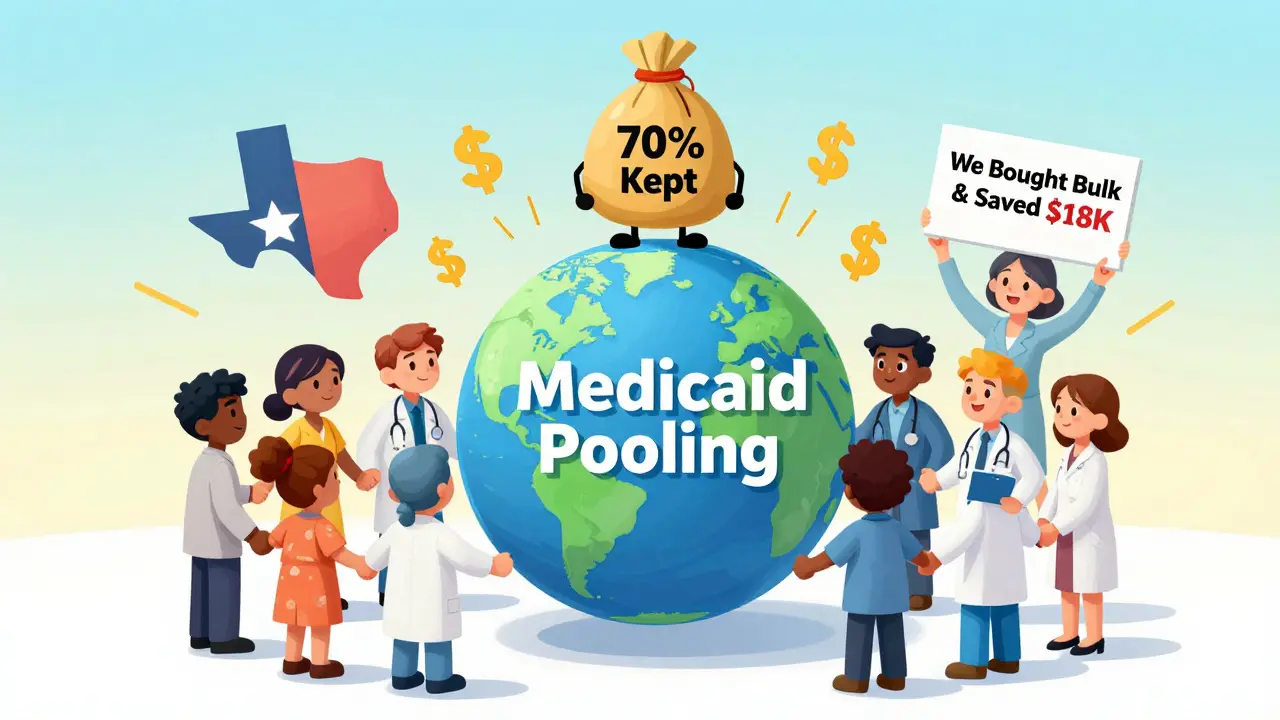

Pharmacy Benefit Managers (PBMs) are the middlemen between insurers, pharmacies, and drugmakers. They negotiate rebates - often 15% to 40% - on generic drugs. Sounds great, right? But here’s the problem: PBMs don’t always pass those savings along. According to USC Schaeffer Center research, only 50% to 70% of rebate money ends up benefiting the patient or the plan. The rest stays with the PBM. State Medicaid programs have found a better way: pooling. Instead of negotiating alone, states like Texas, Florida, and Ohio join forces in multi-state purchasing groups like the National Medicaid Pooling Initiative (NMPI) or the Sovereign States Drug Consortium (SSDC). These groups buy in bulk across millions of patients. The result? 3% to 5% more savings than single-state programs. That might sound small, but for a state with 5 million Medicaid enrollees, it means millions in annual savings.

What Medications Benefit Most From Bulk Buying?

Not all generics are created equal when it comes to bulk savings. The biggest wins come from high-volume, low-complexity drugs:- Lidocaine (injectable and topical)

- Antibiotics like amoxicillin, doxycycline, cephalexin

- Corticosteroids (prednisone, methylprednisolone)

- Saline solutions and IV fluids

- Metformin, atorvastatin, levothyroxine

Why Primary Wholesalers Don’t Offer the Best Deals

McKesson, AmerisourceBergen, and Cardinal Health are the giants. They handle most of the drug distribution in the U.S. But their business model isn’t built on deep discounts. They make money on volume and convenience - not savings. Secondary distributors, on the other hand, survive by offering better prices. They buy in bulk from manufacturers, often taking on short-dated stock or overstock. They don’t have the same overhead as the big three. They’re leaner. They’re focused. And they’re willing to cut prices to win business. A 2023 review of supplier documentation found that secondary distributors scored 4.3 out of 5 for clear pricing guides and support. Primary wholesalers? Just 3.1. That gap matters when your staff is spending hours trying to figure out why a $500 order came with a $15 discount.

What’s Changing in 2025?

The game is shifting. The Inflation Reduction Act is forcing Medicare to negotiate prices on 10 high-cost drugs in 2026 - with projected savings of $6 billion that year. That’s just the start. By 2030, the Congressional Budget Office estimates that expanding those negotiations to Medicaid and commercial plans could save over $1 trillion over 10 years. At the same time, PBMs are being forced to change. Starting in January 2024, the top three PBMs rolled out integrated point-of-sale discount programs. No more separate discount cards. When you fill a prescription for metformin or atorvastatin, the discounted price is applied automatically - because the PBM already negotiated the bulk rate with the manufacturer. The FTC is also cracking down. As of November 2023, there were 17 active investigations into companies manipulating drug prices. That pressure is pushing the whole system toward more transparency.How to Start Bulk Purchasing - Step by Step

If you’re a clinic, urgent care, or small hospital administrator, here’s how to get started:- Identify your top 15 to 20 medications - these should make up 60% to 70% of your drug spending. Use your pharmacy logs or EHR reports.

- Track usage - how many units do you use per month? Per quarter? Don’t guess. Know your numbers.

- Reach out to secondary distributors - Republic Pharmaceuticals, Health Mart, and others specialize in bulk generics. Ask for their discount schedules and minimum order requirements.

- Test short-dated stock - start with one or two high-use items. Order 3 to 6 months’ worth with expiration dates within 9 months. Monitor usage and waste.

- Set up inventory alerts - use spreadsheets or simple software to flag items nearing expiration. Aim for 95%+ utilization.

- Review every 90 days - adjust orders based on actual use. Don’t just buy what you bought last quarter.

The Limits of Bulk Buying

Bulk purchasing isn’t a silver bullet. It won’t fix drug shortages. It won’t stop manufacturers from raising list prices. And it won’t solve the fact that PBMs keep most of the rebates. But it’s one of the most effective tools clinics have right now. For practices operating on thin margins, it’s the difference between staying open and closing down. It’s not about being a big hospital. It’s about being smart. The data is clear: when you buy in bulk, you save. When you buy smart - with short-dated stock, secondary distributors, and good tracking - you save even more.Is bulk purchasing safe for generic drugs?

Yes. Generic drugs approved by the FDA are identical in active ingredients, strength, dosage form, and effectiveness to brand-name drugs. Bulk purchasing doesn’t change the quality. Short-dated stock is still safe to use as long as it’s administered before the expiration date. The FDA requires all generics to meet the same strict standards.

Can small clinics benefit from bulk purchasing?

Absolutely. You don’t need to be a hospital to benefit. Many secondary distributors have minimum order sizes as low as 500 units - which is less than a month’s supply for high-use drugs like amoxicillin or lidocaine. A small urgent care center can save 15% to 25% just by switching 3 to 5 of its most-used generics to a bulk supplier.

Why don’t all clinics use bulk purchasing?

Many still rely on primary wholesalers because they’re familiar or have automatic delivery systems. Others are worried about managing inventory, especially with short-dated stock. Some don’t know where to start. But the biggest barrier is inertia. Once a practice sees a 20% drop in drug costs, they usually switch for good.

Do rebates from PBMs actually lower patient costs?

Not always. PBMs negotiate rebates with manufacturers, but they often keep a large portion. Studies show only half to 70% of those rebates reach the patient or plan. That’s why point-of-sale discounts - where the lower price is applied directly at the pharmacy - are becoming more valuable. Patients pay less upfront, and there’s no mystery about where the savings went.

What’s the difference between a primary and secondary pharmaceutical distributor?

Primary distributors (McKesson, Cardinal, AmerisourceBergen) are the main supply chain. They buy directly from manufacturers and sell to pharmacies and hospitals. Secondary distributors (like Republic Pharmaceuticals) buy from primary distributors or manufacturers, often taking on overstock or short-dated inventory. They focus on niche markets - like small clinics - and offer deeper discounts in exchange for smaller, more frequent orders.