Every time you pick up a generic prescription, you pay a copay. Maybe it’s $10. Maybe it’s $20. You think, “I’m paying for this, so it must be getting me closer to meeting my deductible.” But here’s the twist: generic copays usually don’t count toward your deductible-but they do count toward your out-of-pocket maximum. And that difference can save you thousands.

What’s the difference between a deductible and an out-of-pocket maximum?

Your deductible is the amount you pay for covered services before your insurance starts sharing the cost. For example, if your deductible is $2,000, you pay 100% of your medical bills until you’ve spent that much in a year. Then, coinsurance kicks in-you pay 20%, your plan pays 80%. Your out-of-pocket maximum is the most you’ll ever pay in a year for covered care. Once you hit that number, your insurance pays 100% of everything else for the rest of the year. For 2026, the federal limit is $10,600 for an individual and $21,200 for a family on Marketplace plans. Here’s the key: copays, coinsurance, and your deductible all count toward your out-of-pocket maximum. But only your deductible counts toward your deductible. That’s it.How do generic copays fit in?

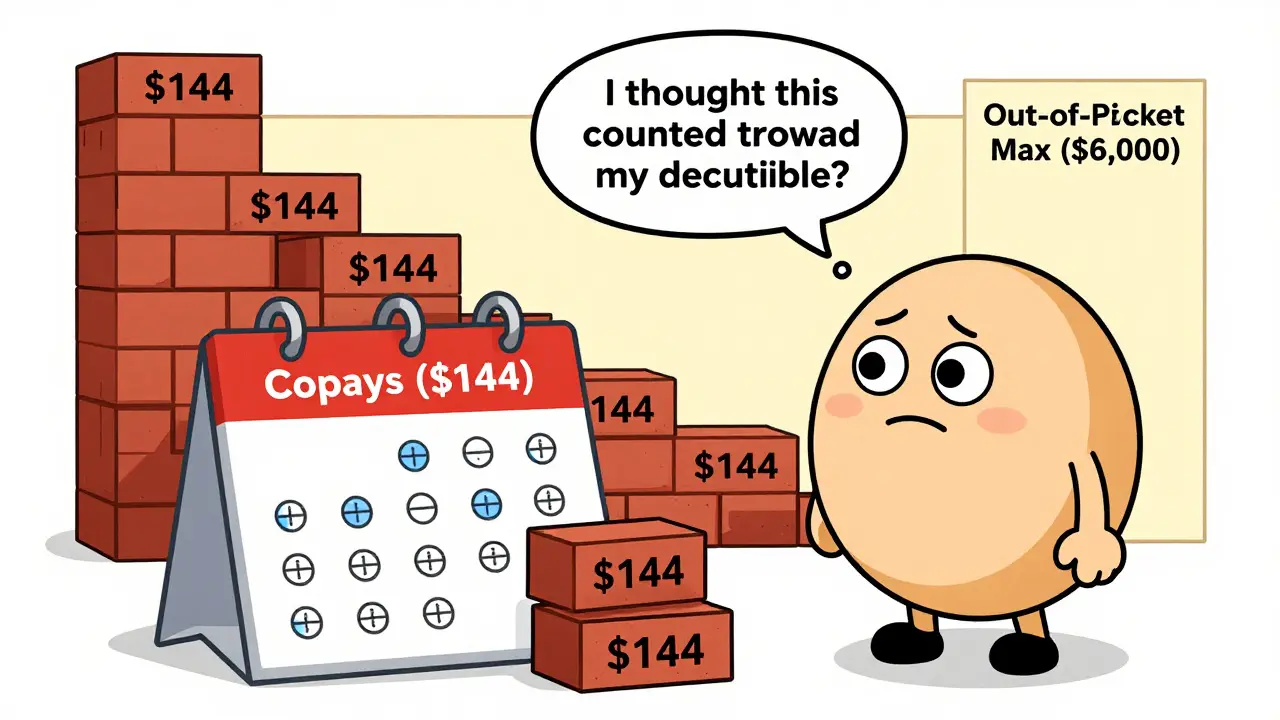

Let’s say you take a monthly blood pressure med that costs $12 per prescription. Your plan has a $1,500 medical deductible and a $6,000 out-of-pocket maximum. You pay that $12 copay every month-$144 a year. You might assume this is chipping away at your $1,500 deductible. It’s not. That $12 goes straight to your out-of-pocket maximum. So after 12 months, you’ve paid $144 toward your $6,000 limit. If you also had a doctor visit that cost $300 (and you hadn’t met your deductible yet), you’d pay the full $300. That $300 counts toward your deductible AND your out-of-pocket maximum. So here’s the real-life scenario: You pay $144 in copays, $300 for a doctor visit, $500 for an MRI, and $800 for a specialist. Your deductible is now $1,600 ($300 + $500 + $800). You’ve met it. But your out-of-pocket maximum? You’ve paid $1,744 ($144 + $300 + $500 + $800). You’re still $4,256 away from hitting your max.Why does this design exist?

Before 2014, copays didn’t count toward anything. You paid them, and they vanished-no progress on your deductible, no protection from high costs. People with chronic conditions paid hundreds a month for meds and still got hit with huge bills later. The Affordable Care Act fixed that by requiring all cost-sharing to count toward the out-of-pocket maximum. It was a win for patients. But the deductible stayed separate. Why? Insurers and policymakers wanted to keep a financial gatekeeper for non-preventive care. The idea: make people think twice before using services. But it created confusion. A 2023 survey found 68% of people thought prescription copays counted toward their deductible. They were wrong.

Three common plan structures (and how they change everything)

Not all plans are built the same. Here’s how your plan is likely structured:- Single deductible (27% of plans): One amount covers both medical and prescriptions. You pay full cost for meds until you hit the deductible, then pay coinsurance. No copays here. This is rare for generics.

- Separate medical and prescription deductibles (37% of plans): You have two deductibles. You pay full price for prescriptions until you hit the prescription deductible (say, $500). Then you pay a $10 copay. That $10 counts toward your out-of-pocket maximum, but not your medical deductible.

- Copay-only with no prescription deductible (36% of plans): You pay your $10 copay right away-no deductible to meet. But again, that $10 doesn’t help your medical deductible. It only moves you closer to your out-of-pocket maximum.

What you need to check in your plan documents

Don’t guess. Look at your Summary of Benefits and Coverage (SBC). It’s required by law and must be easy to read. Find this section:- “Does this payment count toward my deductible?” Look next to “Generic Prescription Drugs.” If it says “No,” you’ve got your answer.

- “Out-of-pocket maximum includes…” It should list copays, coinsurance, and deductible. If it does, you’re covered.

Real stories from real people

One user on Reddit said: “I paid $2,800 in insulin copays last year. Thought I’d met my $2,500 deductible. Turned out I hadn’t. My next surgery was still 80% out of pocket.” Another, with type 1 diabetes, shared: “I hit my $8,500 out-of-pocket max in October. After that, my insulin was free. I didn’t know that was possible until I saw my statement. That’s the system working.” The difference? One person thought copays moved the deductible needle. The other knew they were moving the safety net needle. One was blindsided. The other was protected.

What’s changing in 2025 and beyond

New rules in 2025 require insurers to make this clearer on bills and online portals. You’ll see line items like: “$15 copay-applies to out-of-pocket max only.” Some insurers are testing “integrated deductibles”-where prescription costs, including copays, count toward one total deductible. Early results show patients take their meds more often when they don’t have to juggle two systems. Analysts predict by 2027, 60% of major plans will offer at least one option where generic copays count toward the deductible. But for now, most still don’t.What to do right now

If you take regular prescriptions:- Find your SBC. Open it. Look at the “Generic Prescriptions” row.

- Check if copays count toward your deductible. If not, note how much you’ve paid so far this year.

- Track your out-of-pocket spending. Add every copay, coinsurance payment, and deductible amount.

- Call your insurer if anything’s unclear. Ask: “If I pay $X in copays this year, how close am I to my out-of-pocket max?”

Comments(13)