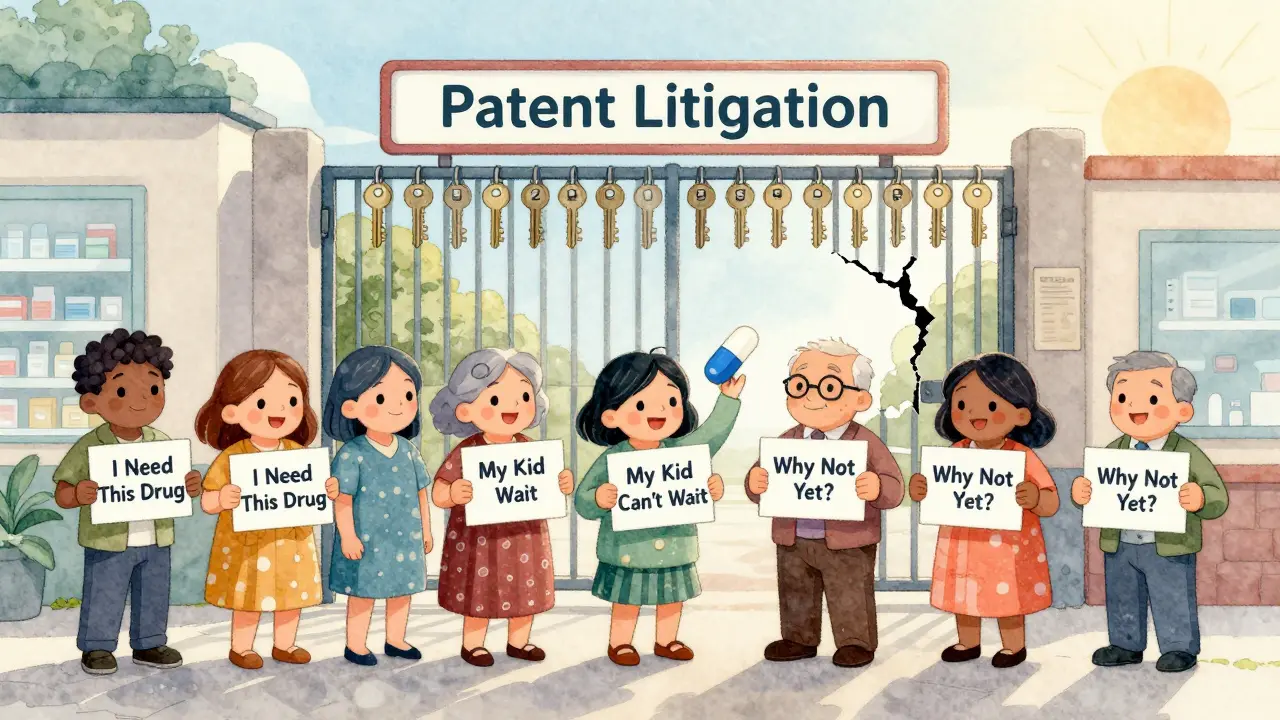

When a new brand-name drug hits the market, it often comes with a price tag that makes patients choose between paying for medicine or paying rent. That’s not an accident. Behind the scenes, patent litigation is quietly stretching out monopolies - sometimes for years - even after the FDA says a cheaper generic version is safe and ready to sell. This isn’t about protecting innovation. It’s about protecting profits.

How the System Was Supposed to Work

In 1984, Congress passed the Hatch-Waxman Act to fix a broken system. Before then, brand-name drug companies held patents for decades, and no one else could make copies - even after the original patent expired. Generic manufacturers had to start from scratch, running full clinical trials just to prove their version worked. That cost millions and took years. Patients paid more. Innovation slowed. The Hatch-Waxman Act changed that. It let generic companies file an Abbreviated New Drug Application (ANDA), using the brand drug’s safety data to prove their version was the same. All they had to do was show their pill had the same active ingredient, dose, and how it worked in the body. In return, they could challenge patents before they expired. That’s where the Paragraph IV certification comes in. If a generic company says a patent is invalid or won’t be infringed, the brand company has 45 days to sue. And if they do? The FDA can’t approve the generic for 30 months - no matter what. That 30-month clock was meant to be a fair pause, not a free pass. But today, it’s become the longest guaranteed monopoly extension in American business.Why Generic Drugs Stay Locked Out - Even After Approval

Here’s the shocking part: the FDA approves generic drugs all the time. In 2023 alone, they approved 90 first-time generic versions of brand-name drugs. But many of those drugs didn’t hit pharmacy shelves for years. Why? Because the 30-month stay doesn’t end when the court case ends. It ends when the clock runs out - and then, the brand companies keep fighting. A 2021 study from the NIH found that the median time between the 30-month stay expiring and the generic actually launching was 3.2 years. That means even if the courts rule in favor of the generic manufacturer, the drug still sits on a shelf. In some cases, the FDA approved the generic 11.5 years after the brand drug launched - nearly five years after the 30-month stay ended. How is that possible? Because brand companies don’t just file one patent. They file dozens. And each one can trigger a new lawsuit. This is called a patent thicket. For example, a drug might have a patent on the active ingredient, then another on the pill coating, another on how it’s taken, another on the manufacturing process. Many of these patents were filed after the FDA approved the original drug. That’s not innovation - that’s legal fencing. In one study, 72% of patents used to block generics were filed after the brand drug hit the market. These aren’t protecting new science. They’re protecting sales.Pay-for-Delay: The Secret Deals That Keep Prices High

Sometimes, the brand company doesn’t even bother to fight in court. Instead, they pay the generic maker to stay away. These are called “pay-for-delay” agreements. The brand company writes a check - sometimes hundreds of millions of dollars - to the generic company, and in return, the generic agrees not to launch for years. The FTC calls this “antitrust poison.” It’s illegal in most industries. But in pharma, it’s common. Between 2000 and 2020, these deals saved brand companies over $10 billion in lost sales. Patients paid the price. In 2010, the FTC found that pay-for-delay deals cost consumers $3.5 billion a year. By 2023, that number had ballooned. One drug, Humira, saw its generic delayed by over two years because of a settlement. Large employers paid an extra $1.2 billion in 2023 just because of that one delay. The courts have started cracking down. In 2013, the Supreme Court ruled these deals could violate antitrust law. But they’re still happening. Why? Because the money at stake is too big. A single blockbuster drug can make $10 billion a year. Paying $300 million to delay a generic for two years? That’s a bargain.

Who Pays the Price?

Patients don’t just pay more. They ration. They skip doses. They go without. A primary care doctor in Chicago told STAT News about a patient who was rationing insulin because the generic version was approved by the FDA but blocked by litigation for 18 months. The patient was paying $1,200 a month for the brand version. The generic would have cost $25. On Reddit, people share stories like this every day: “My kid needs a drug that’s been approved for two years. Still can’t get it. We’re selling things to pay for it.” Employers, insurers, and Medicaid programs pay billions more. Teva, one of the biggest generic makers, admitted in its 2023 annual report that patent delays cost them $850 million in lost revenue. That’s not because they couldn’t make the pills. It’s because they couldn’t sell them. And it’s not just small pills. Biosimilars - cheaper versions of complex biologic drugs like Humira or Enbrel - face even longer delays. Their patent fights take 25% longer on average than regular generics. That means even the newest, most expensive drugs are being held hostage.What’s Being Done - And Why It’s Not Enough

There are signs of change. In 2023, Congress passed the CREATES Act, which makes it harder for brand companies to block generic makers from getting samples of their own drug - a tactic used to delay testing and approval. The FTC has filed more than 100 challenges against patent abuses in 2023 alone. Proposed laws like the Protecting Consumer Access to Generic Drugs Act would limit how many patents a company can list in the FDA’s Orange Book - the official list of patents tied to a drug. Right now, the Orange Book is messy. About 15% of the patents listed are wrong or outdated. Generic companies waste months chasing ghosts. But real reform needs to go further. The system still lets companies file multiple lawsuits over the same drug, one after another. Each one resets the clock. Each one delays access. Each one costs lives. The FTC’s chair, Lina Khan, said in January 2024: “We will continue to aggressively challenge pay-for-delay agreements and other anticompetitive patent practices that keep drug prices artificially high.” That’s good. But words aren’t enough. Courts need to stop treating patent litigation as a legitimate business tactic. It’s a delay tactic.

What’s Next for Generic Drugs?

The future isn’t hopeless. Generic companies are getting smarter. Some are now “launching at risk” - selling the drug before the courts decide if it’s legal. It’s a gamble. If they win, they make millions. If they lose, they pay huge damages. But with the cost of litigation hitting $10 million per case, only the biggest players can afford to play. The top five generic manufacturers now control 45% of the market. That’s not because they’re better. It’s because they can afford to fight. Meanwhile, patients keep waiting. The average delay for a generic drug after FDA approval? 3.2 years. That’s over 1,000 days of people paying hundreds or thousands of dollars more than they should. Without major changes to how patents are used - not just in court, but in Congress - this won’t stop. The Hatch-Waxman Act was meant to bring down prices. Instead, it became a playbook for keeping them high.What You Can Do

You can’t change patent law overnight. But you can ask questions. When your pharmacy says a cheaper version isn’t available yet, ask why. Is it a patent issue? If so, ask your doctor or pharmacist to help you file a complaint with the FDA or your state attorney general. Support organizations pushing for reform. Groups like the Association for Accessible Medicines and I-MAK track these delays and lobby for change. Their reports are public. Read them. Share them. And if you’re paying for a brand-name drug that’s been approved as generic for over a year - you’re not alone. And you’re not powerless.Why does the FDA approve a generic drug but still not let it sell?

The FDA approves a generic drug based on safety and effectiveness. But if the brand-name company files a patent lawsuit within 45 days of the generic’s Paragraph IV challenge, the law forces the FDA to delay final approval for 30 months - even if the patent is weak or invalid. After the 30 months, the brand company can keep suing over other patents, and courts often take years to rule. So the drug sits approved but unsold.

What is a Paragraph IV certification?

A Paragraph IV certification is a legal notice filed by a generic drug company with the FDA, saying that a patent on the brand-name drug is either invalid or won’t be infringed by their version. This triggers the brand company’s right to sue - and starts the 30-month automatic delay on generic approval. It’s the main tool generics use to challenge patents early.

What are pay-for-delay deals?

Pay-for-delay deals happen when a brand-name drug company pays a generic manufacturer to delay launching its cheaper version. The generic company gets a cash payment - sometimes hundreds of millions - and agrees not to compete for years. These deals are anti-competitive and have been ruled illegal in some court cases, but they still happen because the profits are so high.

How do patent thickets delay generic entry?

Patent thickets are clusters of dozens of patents covering minor changes to a drug - like its coating, dosage form, or delivery method - many filed years after the original patent. Each patent can be used to file a new lawsuit, restarting the 30-month delay clock. This creates a legal maze that generic companies can’t navigate quickly, even if the core patent has expired.

Can a generic drug be launched before a patent case is resolved?

Yes - this is called “launching at risk.” A generic company can start selling the drug after receiving FDA approval, even if a patent lawsuit is still ongoing. But if they lose the case, they have to pay the brand company millions in damages. Only large generic manufacturers with deep pockets take this risk - and it’s becoming more common as litigation delays stretch longer.

Comments(12)