When you pick up a prescription at your local pharmacy, you probably don’t think about where that pill was made. But chances are, it wasn’t made in your country. In fact, over 80% of the active ingredients in U.S. prescription drugs come from just two countries: China and India. This isn’t just a statistic-it’s the quiet engine behind every medicine you take. And right now, that engine is sputtering.

The global drug supply chain is one of the most complex, tightly wound systems on Earth. It starts with raw chemicals mined or synthesized in Asia, moves through specialized factories that turn them into pills or injections, then gets shipped across oceans to distributors, and finally lands in your hands. Each step depends on someone else doing their job perfectly. One delay. One shutdown. One trade restriction. And suddenly, your heart medication or insulin is gone.

How We Got Here: The Cost-Cutting Era

It wasn’t always this way. Decades ago, most medicines were made locally. But in the 1990s and 2000s, pharmaceutical companies started chasing lower costs. China and India had the infrastructure, skilled labor, and lower environmental regulations to produce active pharmaceutical ingredients (APIs) at a fraction of the price. By 2025, China alone produced nearly 40% of the world’s APIs. India handled another 35%. The rest? A patchwork of smaller suppliers.

This wasn’t just smart business-it was essential. Generic drug prices dropped by over 60% in the U.S. between 2000 and 2020. Millions of people gained access to life-saving treatments. But the trade-off was vulnerability. When you rely on one region for 75% of your critical inputs, you’re not building resilience-you’re building a single point of failure.

The Breaking Point: 2020 to 2025

The pandemic exposed the cracks. When lockdowns hit China in early 2020, API production slowed. Shipping containers piled up at ports. Air freight costs spiked 300%. By mid-2021, the U.S. saw its worst drug shortage in a decade. Insulin, antibiotics, cancer drugs-all affected. The FDA reported over 400 active shortages by 2023, up from 120 in 2019.

But it didn’t stop there. In 2024, China imposed export controls on 17 key pharmaceutical chemicals, citing national security. India restricted exports of paracetamol after domestic demand surged. The U.S. responded with new tariffs on over $340 billion in Chinese imports, including raw drug ingredients. Each move sent ripples through the system.

By 2025, the average lead time for a shipment from Shanghai to Los Angeles had jumped to 42 days-up from 28 days in 2019. That’s more than six weeks for a single container to cross the Pacific. Meanwhile, U.S. logistics costs for pharmaceuticals hit $127 billion in 2025, up 18% from 2022. Companies that stuck with single-source suppliers saw their inventory costs rise by 30%.

Who Pays the Price?

It’s not just hospitals and pharmacies that feel the strain. Patients do too. A 2025 survey by the National Association of Chain Drug Stores found that 61% of Americans had trouble getting a prescribed medication in the past year. For seniors on fixed incomes, switching to a more expensive alternative meant choosing between medicine and groceries.

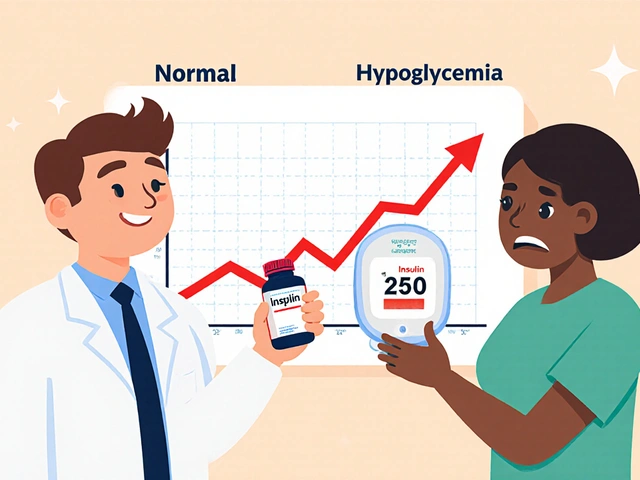

Even routine treatments became risky. A study from the American Journal of Managed Care showed that patients with chronic conditions like hypertension or diabetes were 40% more likely to miss doses during shortages. That’s not just inconvenient-it’s deadly. One 2024 analysis linked a 12% spike in hospitalizations for uncontrolled diabetes directly to insulin supply delays.

And it’s not just about pills. Injectable drugs-like those used in chemotherapy or emergency care-are even more fragile. They require sterile conditions, specialized equipment, and tight temperature controls. There’s no easy backup. If a single factory in Hyderabad shuts down for two weeks, hundreds of U.S. clinics go without.

The Shift: Multi-Shoring and Nearshoring

By 2025, the industry started changing. Companies realized that relying on one region was a gamble they couldn’t afford. The solution? Multi-shoring: spreading production across multiple countries.

Some turned to Mexico. It’s close. The transportation time from Monterrey to Dallas is under 48 hours. Labor costs are 30-40% lower than in the U.S., and regulatory alignment with the FDA is strong. A Fortune 500 medical device maker cut its supply delays by 70% after shifting 40% of its production to Mexico. On-time delivery jumped to 99.2%.

Others looked to Eastern Europe. Poland and Hungary now produce 12% of the EU’s APIs, with growing capacity for U.S. contracts. Vietnam and Indonesia are stepping up too, especially for lower-volume, high-margin drugs.

But it’s not cheap. Setting up a new facility in Mexico or Poland costs 22% more than maintaining an existing one in China. Training local staff, passing FDA inspections, and building new logistics networks takes 18 to 24 months. And not every company can afford it.

The Tech Fix: Digital Twins and AI

Some companies are betting on technology. Digital twins-virtual replicas of supply chains-are now being used to simulate disruptions before they happen. One U.S. pharmaceutical firm used AI to map out 17 possible supply routes for a critical antibiotic. When a port strike hit Shanghai, the system rerouted production through Vietnam and Poland automatically, avoiding a 120-day delay.

Blockchain is helping too. Instead of trusting paper certificates of analysis, companies now use tamper-proof digital logs to verify ingredient origins. One supplier in India cut quality disputes by 65% after adopting blockchain. That means fewer rejected shipments and faster approvals.

But here’s the catch: only 68% of large manufacturers have adopted these tools. Most small and mid-sized firms still rely on spreadsheets and phone calls. And that’s where the next crisis is brewing.

The Real Problem: Workforce and Cybersecurity

Beyond geography and tech, there’s another hidden flaw: people. In 2025, 33% of pharmaceutical companies reported critical shortages in supply chain managers, customs experts, and logistics coordinators. The jobs are hard, underpaid, and often overlooked. Training a new team takes years.

And then there’s cybersecurity. Smart supply chains use sensors, automated warehouses, and cloud-based tracking. But 60% of manufacturers said they’ve been targeted by cyberattacks in the last two years. Ransomware can shut down a production line for weeks. One U.S. generic drugmaker lost $40 million in 2024 after hackers locked its inventory system.

These aren’t theoretical risks. They’re daily threats.

What’s Next?

There’s no magic fix. You can’t just bring all drug manufacturing back to the U.S. Wages here are nearly five times higher than in China. The infrastructure doesn’t exist. And even if it did, it would cost trillions.

The answer isn’t isolation. It’s balance. A smarter mix of sources. Better technology. Stronger regulations. And investment-not just in factories, but in the people who run them.

Some countries are already moving. The U.S. passed the Secure Supply Chain Act in 2024, offering tax credits for domestic API production. The EU launched a €2.1 billion fund for pharmaceutical resilience. India is now investing in its own API supply chain to reduce reliance on China.

But progress is slow. And every day that passes without action, another drug shortage looms.

For now, the system still works. But it’s on borrowed time. And when the next shock comes-whether it’s a war, a climate disaster, or a cyberattack-it won’t be a question of if a drug will disappear. It’ll be a question of which one.

Why are most drugs made in China and India?

China and India developed specialized infrastructure for producing active pharmaceutical ingredients (APIs) at low cost. Lower labor wages, fewer environmental restrictions, and decades of investment in chemical manufacturing made them the cheapest options. By 2025, China produced nearly 40% of global APIs, and India produced another 35%. For generic drugs, where margins are thin, cost dominates decision-making.

How do supply chain disruptions cause drug shortages?

Most drugs rely on multiple steps across different countries. If a factory in China stops making a key ingredient, or a port in India shuts down, or a shipping route gets blocked, the entire chain breaks. Even a two-week delay can cause a shortage because companies don’t keep large stockpiles-they operate on just-in-time inventory. Without backups, hospitals and pharmacies run out fast.

Can the U.S. bring drug manufacturing home?

It’s possible, but not practical for most drugs. Labor costs in the U.S. are 4.8 times higher than in China for comparable work. Building new facilities, training workers, and getting FDA approval takes 5-7 years and billions in investment. It’s feasible for high-value drugs or emergency supplies, but not for low-cost generics that millions rely on daily.

What’s the role of tariffs in drug shortages?

Tariffs raise the cost of imported APIs, which forces manufacturers to either raise prices or cut production. Between 2024 and 2025, the U.S. imposed 12 new tariff categories on pharmaceutical imports, affecting $340 billion in goods. Many companies responded by slowing shipments or reducing inventory to avoid paying extra fees-directly contributing to shortages.

Are there alternatives to China and India for drug ingredients?

Yes. Mexico, Poland, Hungary, Vietnam, and Indonesia are emerging as alternative sources. Mexico offers fast shipping to the U.S. and FDA-aligned regulations. Poland has strong chemical manufacturing capabilities. Vietnam is expanding API production with lower costs than China. Companies using these sources report 20-30% faster recovery from disruptions and fewer supply delays.

How can patients prepare for future drug shortages?

Talk to your doctor early if you take a critical medication. Ask if there’s an alternative brand or generic version. Keep a 30-day supply on hand if possible. Sign up for pharmacy alerts about availability. And don’t wait until your prescription runs out to raise concerns-hospitals and pharmacies are already tracking shortages, and early warnings help them manage better.

Comments(8)